According to CCTV News, on the evening of the 12th local time, Yehia Sareya, the spokesperson for the Houthi armed forces in Yemen, stated in a speech that the Houthi armed forces carried out two attacks on the "Charysalis" ship, which violated their navigation ban, using missiles and drones. The attack locations were the Red Sea and the Strait of Mandeb.

In addition, the Houthi armed forces stated in a statement on July 14th that the navy, drone units, and missile units conducted a joint operation in the Gulf of Aden against the Israeli ship MSC UNIFIC and hit its target.

On the same day, the United States Central Command (USCENTCOM) issued a statement stating that in the past 24 hours, Central Command forces have successfully destroyed two Houthi armed unmanned aerial vehicles (UAVs) and one unmanned surface vehicle (USV) in the Red Sea. The US Central Command successfully destroyed a Houthi drone in an area controlled by Houthi militants in Yemen.

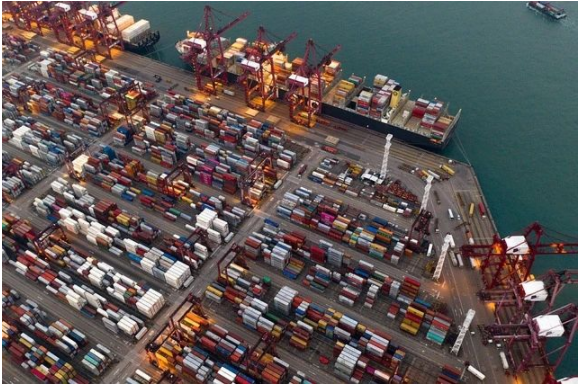

At present, the chaotic situation in the Red Sea is still ongoing, but there are signs of a cooling down in container shipping prices.

On July 12th, the Shanghai Shipping Exchange released the Shanghai Export Container Freight Index at 3674.86 points, a decrease of 1.6% from the previous period, finally ending the previous 13 week upward trend! The previous period's SCFI has shown a slowing trend, with only a slight increase of 0.5% compared to the previous period, reaching 3733.80 points.

In addition, the trend of freight rates on different routes has also begun to diverge

European routes are still on the rise. On July 12th, the market freight rate (sea freight and sea freight surcharges) for exports from Shanghai Port to European basic ports was $5051/TEU, an increase of 4.0% compared to the previous period; The Mediterranean route has experienced a slight decline, with the market freight rate from Shanghai Port to Mediterranean basic ports being $5424/TEU, a slight decrease of 0.1% compared to the previous period

The decline in the US market is more significant. On July 12th, the market freight rates for Shanghai Port's exports to the US West and US East basic ports were $7654/FEU and $9881/FEU, respectively, down 5.5% and 0.6% from the previous period.

It is worth noting that the US West Coast route has experienced a significant decline. In recent times, MSC, ONE, ZIM and other shipping companies have successively launched new routes and overtime ships to the West of the United States. Due to the investment in new capacity and weakened demand, the pressure on this route is easing, and freight rates are cooling down accordingly.

The two major ports in the western United States, Los Angeles Port and Long Beach Port, recently released container throughput data for May. The container throughput of Los Angeles Port in May was 752893 TEUs, a year-on-year decrease of 3%. In the first five months, the total throughput of the Port of Los Angeles increased by 18% year-on-year.

During the same period, the container throughput of Long Beach Port was 695937 TEUs, a year-on-year decrease of approximately 8%. In the first five months of this year, the throughput of the port increased by 10% year-on-year to 3449181 TEU.

After a significant increase, the market freight rates for South American routes have also fallen from high levels this week. The latest market freight rate for exports from Shanghai Port to South American basic ports is 8760 US dollars/TEU, a decrease of 2.9% compared to the previous period.

It is reported that the shipment of new energy vehicles to South America began to decline in July, coupled with the overtime of shipping companies and the investment in new routes, resulting in a significant increase in supply

Add. According to internal sources, in terms of Latin American routes, ship owners have started to lower prices by around $500-1000.

Source: SouHang Network